Currency Downfall: How the Falling Currency Is Shaping India’s Real Estate Market

India’s real estate sector has always been deeply influenced by economic indicators—GDP growth, interest rates, liquidity, and global market movements. But one factor that often goes unnoticed by common buyers and small investors is the value of the Indian Rupee.

When the rupee weakens against the US dollar, it sets off a chain reaction across industries, and real estate is among the sectors most impacted.

In this blog, we break down how the rupee’s downfall affects property prices, demand, investors, and the future of Indian real estate.

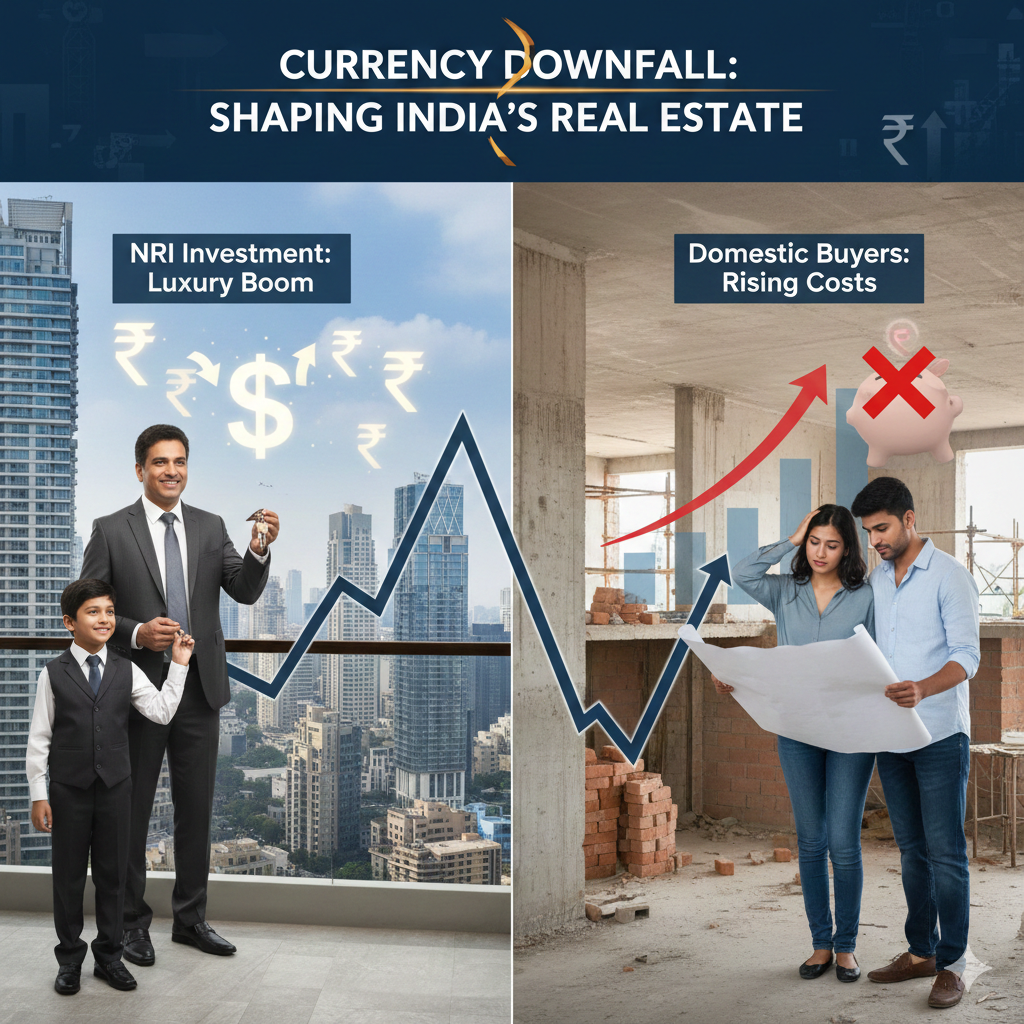

1. Higher Construction Costs Lead to Rising Property Prices

A weakening rupee makes imports costlier. The real estate and construction industry imports several key materials like:

-Steel

-Copper

-Aluminum

-Heavy machinery

-Advanced fittings & façade materials

When the rupee falls, builders’ overall costs rise, and this often leads to higher property prices or slower project execution.

Even domestic materials become costlier due to inflationary pressure.

2. Increased Demand from NRIs (A Positive Side)

For Non-Resident Indians (NRIs), a falling rupee acts as a buying opportunity.

When the rupee drops:

-NRI buyers get more value for the same amount in dollars.

-High-end and luxury properties become more attractive.

Investment in commercial real estate increases as rental yields are paid in rupees but bought in cheaper dollars.

This often leads to a spike in NRI bookings, especially in markets like:

-Mumbai

-Delhi NCR

-Bengaluru

-Pune

-Hyderabad

3. Home Loan EMIs May Get Affected

A rupee downfall increases inflation.To control inflation, the Reserve Bank of India may raise interest rates, resulting in:

-Maybe higher home loan EMIs

-Reduced affordability for middle-class buyers

-Developers focusing more on premium housing, where margins are higher

-This can slightly slow down residential demand in the mid/affordable segment.

4. Foreign Investment in Real Estate Gets a Boost

A weakened rupee attracts:

-Foreign Direct Investment (FDI)

-Real estate private equity

-Global REIT and institutional investors

Why? Because global investors can buy Indian assets at a lower currency cost, while rental income and property appreciation provide profitable returns.

This strengthens:

-Commercial real estate (offices, IT parks)

-Warehousing

-Co-living & co-working spaces

-Hospitality and tourism-related real estate

5. Construction Delays Become More Common Costlier imports + higher borrowing costs often lead to:

-Delayed project timelines

-Slower completion rates

-Developers revising project planning

-Reduced new project launches in some regions

-Budget-focused and smaller developers are impacted the most.

6. Rising Inflation Pushes Up Land Prices

When the rupee falls, inflation rises.

Higher inflation increases:

-Land acquisition costs

-Labour wages

-Material charges

-This puts upward pressure on property prices, especially in urban and high-demand zones.

7. Strong Potential for Rental-Based Investments

As buying becomes expensive, many buyers postpone purchases and choose renting.

This boosts:

-Demand for rental homes

-Co-living spaces

-Holiday homes & Airbnb-style rentals

-Student housing and PG accommodations

-Investors with rental properties often earn higher yields during currency fluctuations.

Conclusion: Is Rupee Downfall Good or Bad for Real Estate?

The fall of the Indian rupee is a double-edged sword for the real estate sector.

Negative Impacts:

-Higher construction costs

-Rise in home loan EMIs

-Delayed projects

-Increased inflation

Positive Impacts:

-Surge in NRI property demand

-Higher foreign investment

-Better returns for rental investors

Overall, while the rupee depreciation creates short-term challenges, it also opens a window for global and NRI investors to capitalize on India’s growing real estate potential.

For end-users, the impact varies—affordable housing becomes slightly expensive, while investors in rental or commercial segments see better opportunities.